1. A New Generation Walks Into the Market

A quiet revolution is taking place — not in Delhi’s Parliament or on the streets of Bengaluru, but in the apps and browsers of everyday Indians. From the college student in Patna to the homemaker in Surat, people are now learning how to buy shares online, not by reading economic journals, but through trial and error, and a few viral YouTube videos.

This isn’t about overnight riches. It’s about curiosity meeting access — about finally being able to invest in the companies we see every day, in brands we’ve grown up with, or in sectors we believe the country will grow into.

2. Opening a Trading Account Is the New 18th Birthday Gift

It used to be a pen. Then maybe a savings account. Today, parents are opening a trading account for their kids when they turn 18. It’s not just a tool; it’s a rite of passage — a new kind of financial education that happens outside classrooms. The first step is now just a few taps away, and that accessibility has changed everything.

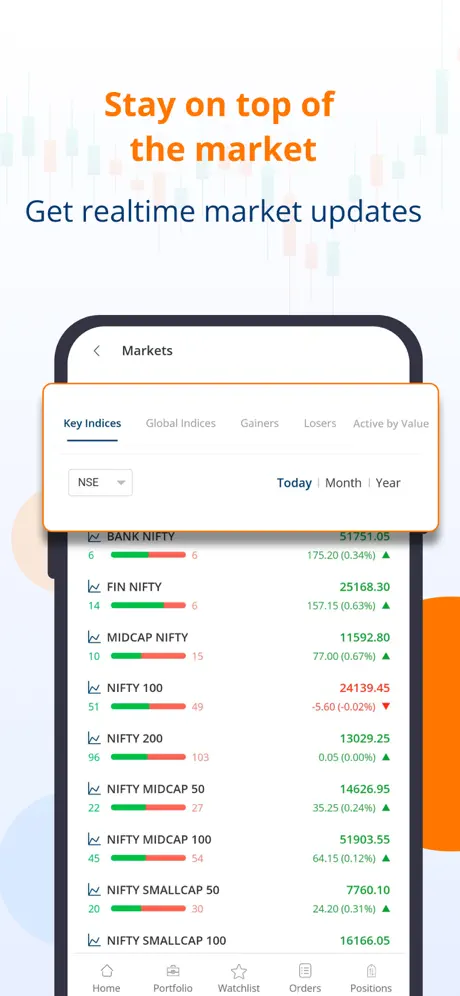

3. Share Market Apps in India Are Built for People Like Us

No, you don’t need a Bloomberg terminal. You just need a stable internet connection and one of the many share market apps India now offers. These platforms aren’t perfect, sometimes they freeze, and the UX can feel like a maze, but they’re designed for humans, not just traders in suits. They show us graphs in digestible shapes. They alert us before a stock dives. Some even offer bite-sized courses and community chatrooms, where advice flies faster than the Sensex moves.

4. Online Share Trading Isn’t a Game — But It Feels Like One

There’s adrenaline, there’s risk, and there’s the oddly thrilling refresh button. Online share trading is undeniably engaging, and that can be both a gift and a trap.

Some treat it like a game. Others treat it like sacred ground. The truth is, it can be both as long as you walk in with your eyes open. Trading online allows us to respond in real-time to news, market swings, and sometimes, gut feelings. But it also teaches patience and the importance of not reacting to every red arrow.

5. Online Investment Is a Language We’re Still Learning

You don’t have to be an economist to understand online investment — you just need to care about your future. Whether it’s mutual funds, direct equities, or SIPs in blue-chip companies, investing today feels less like a financial activity and more like a form of personal agency.

We’re no longer waiting for someone to do it on our behalf. We’re not handing over control to a bank manager or a family friend who “knows the market.” We’re Googling, we’re testing, we’re asking. We’re taking ownership.

6. The Market Has Room for You, Too

If you’ve ever felt like investing wasn’t for people like you — that it required suits, jargon, or insider tips — it’s time to let go of that notion. The stock market is noisy, yes. But it’s also vast, and it has room.

Room for the cautious, the curious, the dreamers, and even the sceptics.

So whether you’ve already dipped your toes in or are still circling the shore, remember: your pace is yours. And there’s no right way to begin — there’s only beginning.