Investments are not only for financial experts but for everyone, be it a student or professional, earning or retired. Online trading, including stock markets, is one of the most popular investment options. Everyone knows at least something about it; they have either invested in it already or have considered doing so at some point.

Purchasing shares (or stocks ) of publicly traded companies with the intention of generating returns through dividends and capital appreciation (price increases) is known as stock market investing. By purchasing stocks in a company, you are effectively becoming a shareholder and purchasing a portion of that business.

Stock Market Investment Tips For Beginners

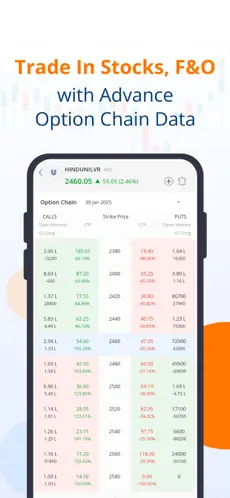

The secret for novices is to start small, grasp the fundamentals, and progressively expand your portfolio. Investing no longer requires phoning a broker or filling out paperwork. These days, you can use a share market app on your smartphone to buy, sell, track, and manage your investments.

A good stock market app should include features like powerful tools, low brokerage, simple UI, good analytics, and a safe experience overall.

Always look out for probable red flags, avoid penny stocks, don’t be in a rush to invest, and keep in mind the following:

- Don’t base your investment solely on rumors and hearsay. Research thoroughly and look for potential gains and losses.

- Things that rise quickly can also fall quickly.

- Confusion and high transaction costs result from frequent buying and selling.

- Recognize dividends and stock capital gains taxes. Everything is taxed; budget carefully.

- After careful consideration, choose the best trading app and check for hidden charges. There should be full transparency, and you should know where your money is being spent.

- Don’t chase hot stocks. What is trending today may be a flop tomorrow. Instead, go for long-term investments.

- Have a plan, record your progress, and journal your journey so that you don’t fall into addictive habits.

- Don’t invest out of pocket. If you can’t handle a big loss of money, don’t invest in that stock, hoping otherwise. Nothing can be predicted for sure, so be very careful with your hard-earned money.

- Invest in Systematic Investment Plans (SIPs) in stocks or mutual funds to average out market risks.

- Examine apps for virtual trading to get experience without having to risk real money. They can be a very good practice and a test of your skills.

Here’s the summary of what we have discussed so far:

- Make long-term investments in amounts you can afford to hold. Don’t make a big commitment right away.

- Avoid investing all of your funds in a single stock. Create a diversified, well-balanced portfolio.

- You shouldn’t buy a stock just because everyone else is. Conduct independent research.

- Wealth in the stock market is not created overnight. Your superpower is patience.

- Keep tabs on government regulations, economic news, earnings, and quarterly outcomes that affect the market.

Conclusion

Stock market investing can be a very safe and wise option if you steer clear of high-risk speculation and make prudent investments. The Securities and Exchange Board of India, or SEBI, oversees all trades in India, and your Demat account is a secure place to keep your shares. To protect funds and data, only use brokers and apps you can trust.