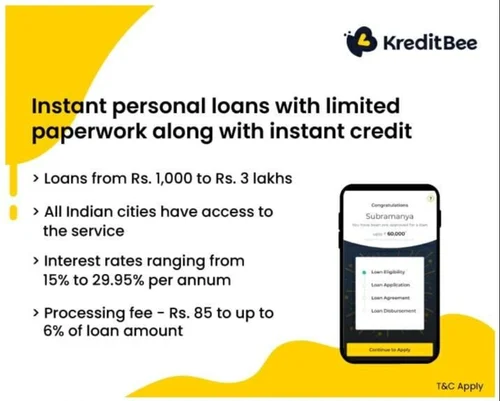

Personal loan apps are a big hit on the internet. These apps and platforms provide quick personal loans to individuals without making them undergo tiresome paperwork. If you face a personal loan emergency, these apps are ideal to help you out.

The best part is the instant pay feature, which helps individuals to get the amount within minutes.

However, with great power comes great responsibility. Once you have taken the loan, you must make regular payments to avoid high interest rates and penalties.

Mentioned below are a few tips and tricks to repay your personal loan faster.

Evaluate the Loan Terms & Conditions Carefully

Before even applying for a loan from a top Indian loan app, you must take time to read the terms and conditions, loan repayment schedule, payment methods available, and more. Doing so will help you understand if the loan platform is right for you and if you have enough funds in your savings account to be able to repay the loan amount on time.

Clear Loans With Shorter Tenure First

If you have multiple existing loans like personal loans, a travel loan, gold loan, and you are running low on savings, you must clear a few before high-interest rates start piling up.

To do so, start by focusing on loans with a shorter tenure and higher interest rates first.

Reduce the Tenure or Make Extra Payments

Reducing the tenure by increasing the EMI amount will help you get rid of the advance loan early. However, you must only do this if you have enough funds in your account.

If at any point you get some extra money, try to make some extra payments. This will help you stay ahead of your loan repayment schedule, which reduces the amount you pay in interest.

Maintain a good budget.

After taking a loan, try to create a budget that will allow you to take off your expenses with the EMIs. Cut some corners if it is necessary.

Nowadays, where e-payment is a big hit, it is common to get distracted and spend more without keeping track of your money.

If you know how much to spend, you won’t have any problem making on-time payments.

Keep a little money separately in your savings account for emergency situations.

Consolidate Your Debt

For the ones having multiple loans, there is an option of combining all the existing loans into one.

Yes, you will have to pay the consolidated loan. But you can tweak the loan terms and conditions in your favor. The smart thing to do here is to go for a higher loan amount with lower interest.

This can also help you increase your credit score.

Utilize the Cashback Feature

Many apps and platforms have a referral program that helps you earn good cashback. Try to utilize the feature to its fullest to get more money to settle the loan.

Conclusion:

Personal loan platforms are great, but you must handle them properly. Be it a salary loan or a small travel loan, not being able to pay your EMIs on time will punch a big dent in your credit score. This is why you must use the tips and tricks in the article to pay your loans and debt-free quickly.