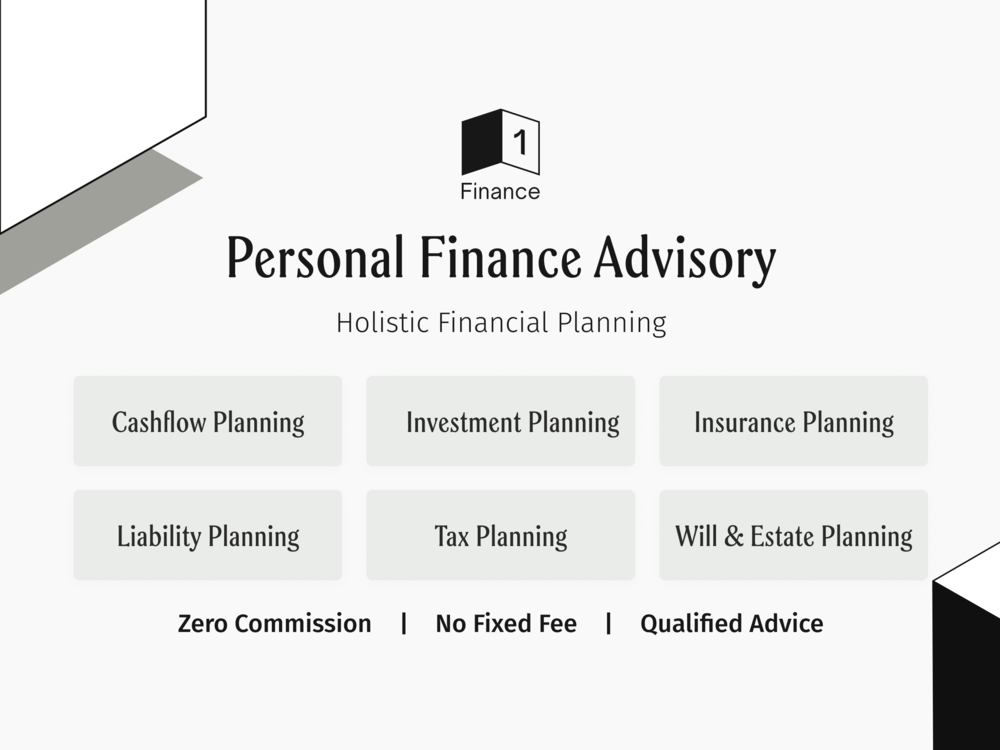

It’s no secret that an efficient, holistic, and well-thought-out financial plan can pave the path to financial liberty, enabling individuals to navigate daily activities without having to stress about their finances. Financial planning is a diverse facet of life that consists of many subsets, each necessitating thoughtful assessment of needs, goals, and risks. However, one such aspect of financial planning that people often disregard is insurance planning.

Is Insurance Important?

Professional financial advisors usually have a distinct perspective on insurance planning compared to a layperson because they designate insurance as an essential element in the holistic liability planning process. While the concept of insurance might sound straightforward, it actually is quite intricate in hindsight. A component of insurance that people are often unaware of is commissions. Insurance premiums are usually inclusive of the commission that is supposed to go to the insurance agent.

Why is it Necessary for Policyholders to Know about Commissions?

Without complete knowledge of the commission component on insurance premiums, it’s difficult for an anticipated policyholder to make wise decisions about the insurance plan they want to purchase without the transparency about the commission:

- An individual can’t grasp if an insurance agent is recommending an insurance plan because of the commission or because the plan is in the best interest of the policyholder.

- It isn’t easy to foster a genuine relationship between the policyholder and the insurer. If there’s no trust, a policyholder may back out of the insurance policy. Eventually, that’ll lead to the policyholder being less financially secure.

So, How Can We Ensure Transparency?

Luckily, financial advisory services have acknowledged the need for transparency and have developed tools like commission analysers to promote informed liability management. By entering fundamental details such as the insurance type, premium amount, payment frequency, and duration of premium payments, a policyholder can get an estimate of the commission based on the robust methodology employed by the commission analyser tool.

Some commission analysers also offer a score for various parameters, such as the insurer’s claims experience, claim settlement ratio, and many more. Additionally, to ensure that all commission analyser models stay updated with the latest changes, the evaluation methodology and assessment criteria, and metrics are reviewed bi-yearly.

Is there any Official Regulatory Authority for Insurance?

Just like the Income Tax Department serves as the official authority providing regulations that form the backbone for efficient tax planning, the IRDA is responsible for providing insurance-related regulations. According to the IRDA’s new regulations on commissions on insurance, it’s quite clear that the cap on commissions has been removed.

Under the new regulations, the previous commission cap has been substituted with a broader cap on insurers’ management expenses. These changes are seen as beneficial for policy buyers because they promote flexibility in managing expenses for insurance companies and aim to bring more discipline and profitability to the industry. The limit on management cost, in turn, is expected to result in better pricing of products for customers. It’s also expected to stimulate innovation and customer-centric operations in the insurance sector, potentially increasing insurance penetration.

Overall, the commission is an omnipresent concept that even permeates the realm of insurance. Policyholders need to know about the commission component of their insurance premiums to understand if the policy is truly in the best interest of the policyholder. To promote transparency, commission analyser tools serve as an indispensable resource and for more information visit – https://1finance.co.in/.