The online stock market is a dynamic ecosystem shaped by various factors, including technological advancements, economic shifts, and global events. Understanding the current trends in this ever-evolving landscape is crucial for investors looking to navigate the markets successfully. Here’s a comprehensive look at some of the prevailing trends influencing the online share market.

Rise of Retail Investors:

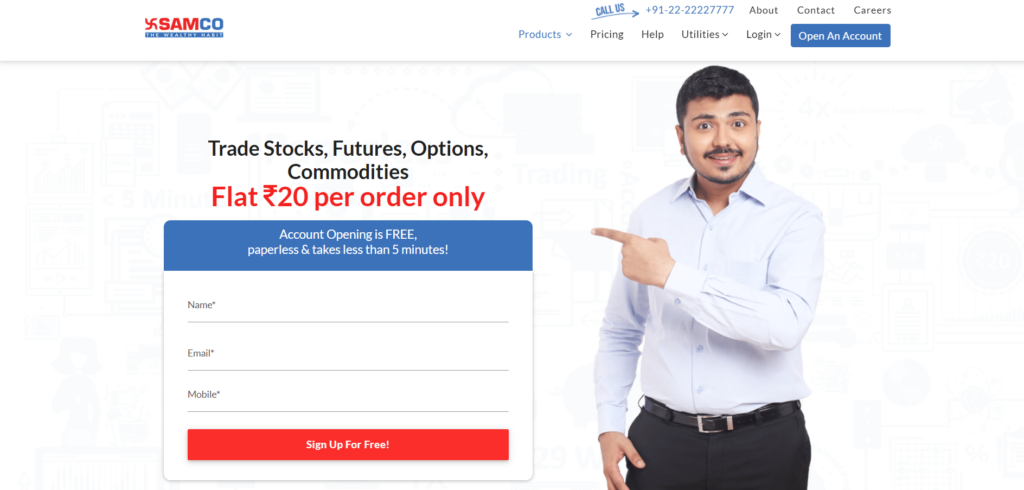

In contemporary times, a noticeable shift is the rise of retail investors who are trading stocks online. Easy access to trading platforms, zero-commission trades, and investment democratization through apps have enabled regular folks to take an active role in share markets. This incoming wave of non-professional players has played its part in market rhythms, causing escalated fluctuations on popular shares like those escalating due to memes or firms bearing high social media chatter.

Technological Advancements and AI:

Technology continues to revolutionize stock trading. AI and machine learning algorithms are increasingly utilized for market analysis, trend predictions, and automated trading. Robo-advisors are gaining popularity. They provide personalized investment advice, such as when to buy or sell equity shares, based on algorithms and user data analysis.

SPACs and IPO Frenzy:

Special Purpose Acquisition Companies (SPACs) and Initial Public Offerings (IPOs) have been prominent in the market. SPACs, also known as “blank-check companies,” have raised substantial capital, although their performance has been scrutinized lately. Additionally, the NSE market witnessed the debut of high-profile IPOs across various sectors, attracting investor attention and sometimes causing significant market fluctuations.

Cryptocurrencies and Blockchain Technology:

The amalgamation of conventional finance and digital assets has seen considerable expansion as cryptocurrencies have progressed to the spotlight. Despite their volatility, virtual currencies such as Bitcoin and Ethereum are capturing escalating acceptance from non investors and investors alike. Simultaneously, there’s a surge in the exploration of blockchain technology for its prospective power to reshape facets of financial markets radically—be it trading schemes or settlement patterns—even marking significant changes in record-keeping methods.

Regulatory Changes and Geopolitical Uncertainties:

Regulatory shifts and geopolitical events will continue to influence the BSE stock market. Changes in policies related to taxes, trade agreements, or monetary policies can impact investor sentiment and market stability. Geopolitical tensions, global conflicts, or unexpected events, such as the pandemic, have historically demonstrated their ability to affect market behavior and trends swiftly.

Remote Work and Changing Consumer Behavior:

The shift to remote work and changes in consumer behavior due to the pandemic have fueled the growth of certain sectors, such as technology, e-commerce, and healthcare. Investors are closely monitoring companies adapting to the evolving landscape, seeking opportunities in industries poised for continued growth in the post-pandemic world.

In conclusion, the online stock market is a dynamic ecosystem shaped by a myriad of trends and influences. Investors must stay informed, adapt to changing conditions, and diversify their portfolios to navigate the complexities and seize opportunities presented by these current trends. Balancing risk and reward while staying attuned to market shifts remains imperative for success in the online stock market arena.